nc sales tax on food items

Candy however is generally taxed at the full. Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale.

Minnesota Sales And Use Tax Audit Guide

When calculating the sales tax for this purchase Steve applies the.

. Application of Sales and Use Tax to Retail Sales and Purchases of Food Sales and purchases of food as defined in GS. The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged. Alaska Delaware Montana New Hampshire Oregon 6 Hawaii Idaho Kansas Oklahoma South Dakota and Wyoming tax food at the full state.

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. North Carolina sales and use tax law provides an exemption for sales of mill machinery machinery parts and manufacturing accessories however these items are subject. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

North Carolina doesnt collect sales tax on purchases of most prescription drugs. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2. As a business owner selling taxable goods or services.

5 Five states do not impose state sales tax. North Carolina Sales Tax Exemptions. The North Carolina NC state sales tax rate is currently 475Depending on local municipalities the total tax rate can be as high as 75.

A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones. This page describes the. Typical county total taxes are 675 to 7 percent.

North Carolina counties may add a sales tax of up to 275 percent tax. What transactions are generally subject to sales tax in North Carolina. Is Food Taxable In North Carolina Taxjar Businesses having employees.

The transit and other local rates do not apply to qualifying food. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Sale and Purchase Exemptions. Candy however is generally taxed at the full.

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. The 2022 North Carolina State Sales Tax.

The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically. 53 rows Table 1. The sales tax rate on food is 2.

Items subject to the general rate are also subject. County and local taxes in most. The counties with the highest combined rates are.

105-164310 are exempt from the State sales and use tax and. The Dare County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Dare County local sales taxesThe local sales tax consists of a 200. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being.

31 rows The state sales tax rate in North Carolina is 4750. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy.

Vermont Sales Tax Small Business Guide Truic

How To Market Snow Balls Snow Cone Stand Shaved Ice Shave Ice Syrup Recipe

Which States Require Sales Tax On Clothing Taxjar

![]()

Prepared Food Beverage Tax Wake County Government

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Budget Food Shopping Harris Teeter

Illinois Sales Tax Guide For Businesses

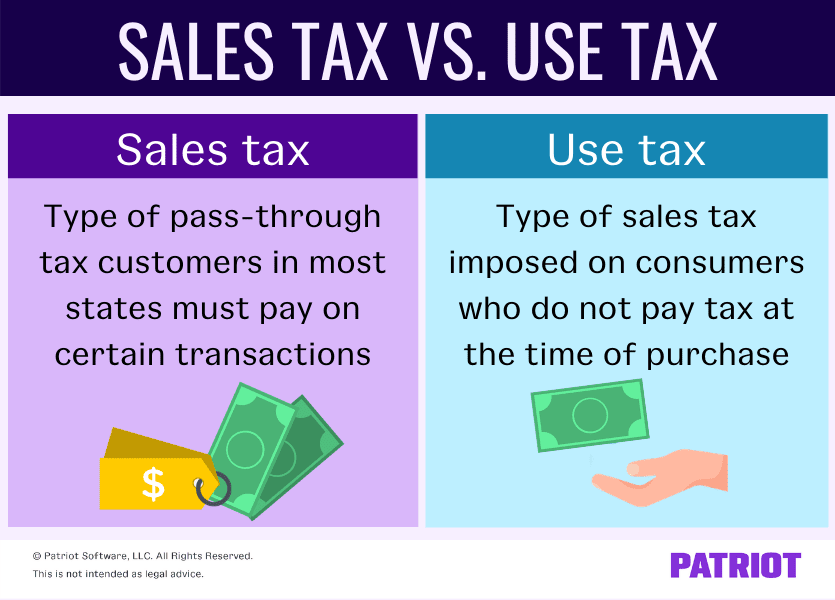

Sales Tax Vs Use Tax How They Work Who Pays More

North Carolina Sales Tax Handbook 2022

Illinois Sales Tax Guide For Businesses

How To File Sales Tax In Each State Taxjar

Kelly Goes Shopping For Sweet Food Sales Tax Repeal Settles For Gradual Reduction Kansas Reflector

Sales Tax And Accounting Basics For Interior Designers Foyr

How To Calculate Sales Tax A Simple Guide Bench Accounting

Pin By Xinedonovan On 2021 Tax Receipts Card Holder Credit Card Cards

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

California Sales Tax Small Business Guide Truic

Save On Sectionals At Bowen Country Style Furniture Country Furniture Casual Furniture